It’s been a long time coming, but Spain’s digital nomad visa is finally a reality, and the first acceptances have already been granted.

So if you have been waiting to hear about how you might be able to come and live and work in Spain as a remote worker or independent entrepreneur, here is everything you need to know – in association with our legal and financial advisors, Entre Trámites:

This conversation covers general visa eligibility, along with questions and answers about how to apply. We also discuss what you will need by way of supporting evidence.

Yes, you can apply for the visa yourself. However, one important lesson about coming to live in Spain is that it’s often easier and worthwhile to outsource administration and documentation to the experts. This is particularly true if your situation is in any way complex or atypical (frankly, even if it is not…) It’s not an immigrant issue, most Spanish people also do this!

So, we are very fortunate that Entre Trámites offer a free initial immigration consultation to our readers. This will help you determine your individual needs and next steps. Many questions about eligibility and general terms get answered in the video, but everybody’s situation is unique.

Even more importantly, this is brand-new law… While it sits within a context of existing visas and pathways, to live and work in Spain. It’s important to understand that this visa may be a path to long-term residence, even citizenship, in Spain. But whether it’s the right path for you depends on many individual factors.

Precedent and practice is still emerging, and as such, it makes a lot of sense to partner with a professional firm whose job it is stay on top of all of this for you. This will help you optimise timing and approach for best chances of success, with Spain’s digital nomad visa.

Eligibility for Spain’s digital nomad visa

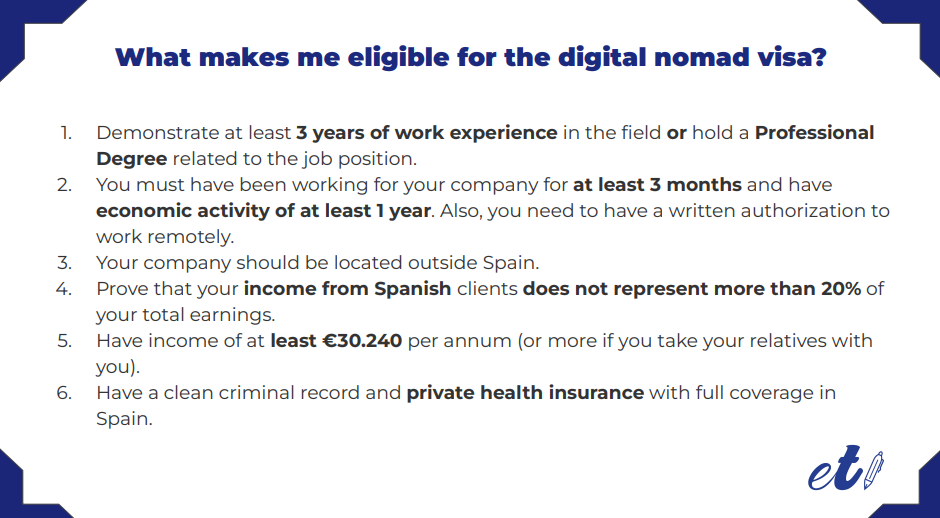

Meanwhile, here is the key slide from the video, highlighting the main eligibility criteria for the visa:

What about tax, with the Spain digital nomad visa?

The answer to every question about tax in Spain is usually, ‘it’s complicated!’

With the new visa, that’s still true. However, within complexity you find choice… and Louis Williams from Entre Trámites unpacks the different options you have. These range from Beckham’s Law to self-employment to forming a business, so it’s vital to make an informed choice.

The best one for you will depend on your income, and how that might vary over time, as well as its source. It also depends on your long-term plans and intentions, for staying in Spain.

Decisions about tax compliance are very complex and individual, but Entre Trámites support to Spanish residents with all taxes. Again they support Remote Work Spain with a free initial consultation, to help you with self-employed or personal tax issues.

I would imagine quite a few digital nomads won’t fit into autonomo/ self employed or Beckhams law. They will be subjected to the Spanish worldwide income taxes. And, that ain’t a pretty situation.

Correct, they will have the same conditions as the rest of us living here (and the wealth tax applies to autónom@s also)