Self-employment is a classic route to remote working in Spain for many immigrant, expat, and digital nomad professionals. But the autónomo payments system, through which self-employed people contribute to social services, is changing radically from the 1st January 2023.

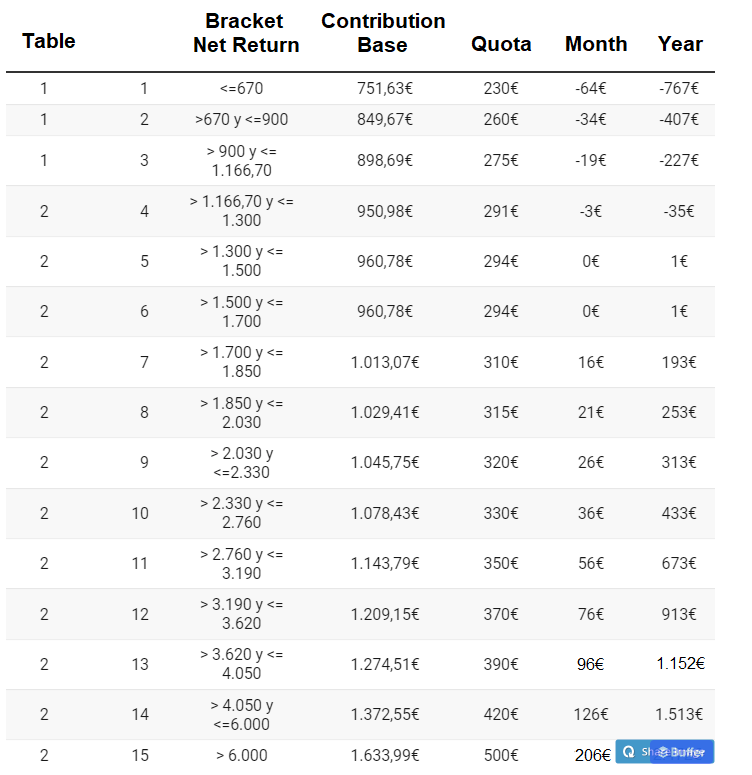

The existing flat rate will be replaced by an income-related tariff, and in the year ahead, minimum payments will range from €230 for the lowest earners, to €500 for the highest. These autónomo payment bands are set to alter in both directions through 2024 and 2025 – with the lowest earners paying less, and higher earners paying more.

As with every fiscal policy change in the world, there will be winners and losers. The scheme is more fair and progressive, but it is more complicated. The new system of income band tramos and cuotas will also combine with changes to special allowances for new starters, small municipalities, and younger people.

In other words…

Autónomo payments are getting more complex!

Confused? That’s understandable. These are big changes to the existing autónomo payments system. Which is why I sat down with Louis Williams from Entre Trámites to unpack all the details, on December 20th 2022.

You can find the full recording in this video. Meanwhile the table of 2023 contributions, which is quite hard to make out in the video, is right here:

Do you still have questions, or want further advice about your own situation?

No problem, Entre Trámites are offering all Remote Work Spain readers a free personal consultation, to review your individual situation and how these changes will affect you.

Entre Trámites and Remote Work Spain

Tax and social security changes are often worrying and confusing, even when you’re dealing with them in your first language. You can fear doing something wrong, or overlooking a crucial obligation. Dealing with cross border matters is even more complicated! Global taxation systems don’t work happily together…

Which is why I work with Entre Trámites to manage my own finances. I recommend them to you from personal experience.

If you contract with Entre Trámites via links on this site, it helps to support hosting and other costs for Remote Work Spain – so that’s a win-win.

Add comment